How Executive Search Firms Can Reduce Sourcing Debt with AI

In the high-stakes world of executive recruiting, speed and precision aren’t just nice to have—they’re non-negotiable. Every day spent chasing elusive candidates or combing through unqualified profiles isn’t just wasted effort; it represents a significant opportunity cost. This daily grind often conceals a larger, systemic issue that plagues many executive search firms: sourcing debt.

If you haven’t heard of sourcing debt, you’re not alone. But understanding it—and how to eliminate it—could be the key to transforming your search process.

What Is Sourcing Debt?

The challenge is real:

Sourcing debt refers to the inefficiencies that accumulate in your recruitment process when pipelines lack structure, strategy, or optimized tools. It’s similar to technical debt in software development—those shortcuts or legacy systems that might work in the short term but create bottlenecks over time.

For executive search firms, sourcing debt often takes the form of:

- Spending hours staring at unqualified profiles.

- Using outdated or incomplete candidate data.

- Relying on disconnected tools that don’t work seamlessly together.

- Failing to surface the best candidates in a timely manner.

These inefficiencies don’t just slow you down; they can damage your reputation with clients, reduce profitability, and undermine your ability to secure future mandates.

The Cost of Sourcing Debt

The impact of sourcing debt goes beyond lost hours:

- Client Relationships: Delivering subpar or late results risks eroding trust with your clients.

- Competitive Advantage: Falling behind firms that are already leveraging modern sourcing techniques can cost you valuable mandates.

- Team Morale: A manual, inefficient process frustrates your team, leading to burnout and turnover.

How AI Eliminates Sourcing Debt

Fortunately, sourcing debt is solvable. By leveraging AI, executive search firms can modernize their processes, eliminate inefficiencies, and deliver faster, higher-quality results.

1. Fresh, Dynamic Data

AI-driven tools keep candidate information up-to-date automatically. This means your team can avoid wasting time on outdated resumes or stale LinkedIn profiles. You’re always working with current, actionable data.

2. Precision Matching at Scale

AI can analyze thousands of data points to find the exact candidates who match your client’s needs, far beyond traditional keyword searches. This eliminates the need to cast a wide net and sift through irrelevant profiles manually.

3. Workflow Automation

Repetitive tasks like screening and shortlisting can be automated, freeing up your team to focus on high-value activities like client engagement and candidate outreach.

4. Scalability for Any Mandate

Whether you’re handling a single high-stakes search or juggling multiple projects, AI scales seamlessly to meet your demands without sacrificing quality or efficiency.

5. Data-Driven Insights

AI doesn’t just help you source candidates—it helps you refine your entire process. By analyzing trends and patterns, you can adjust strategies to improve outcomes over time.

Taking the Next Step: Evaluating AI Solutions

The right AI tools can significantly reduce sourcing debt, but selecting the best solution for your firm is crucial. When evaluating platforms, consider:

- Integration: Does the tool integrate seamlessly?

- Customization: Can it adapt to the unique requirements of your clients and searches?

- Analytics: Does it offer insights that improve your process over time?

- Support: Is there a dedicated team to help you maximize the tool’s potential?

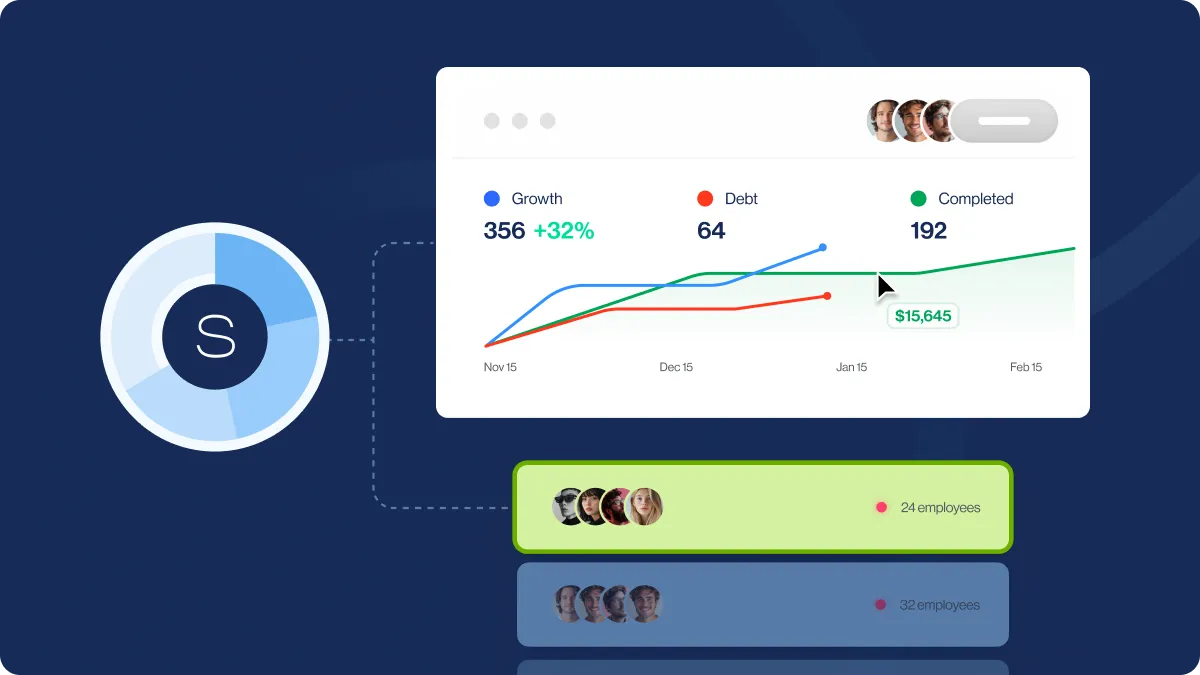

AI solutions like SiftScore are specifically designed to tackle sourcing debt, but the principles apply regardless of the platform you choose. The goal is to implement technology that reduces inefficiencies while enhancing your team’s effectiveness.

Building a Debt-Free Future for Executive Search

Eliminating sourcing debt isn’t just about improving your efficiency; it’s about staying competitive in a rapidly evolving industry. The firms that succeed are those that embrace innovation to deliver better, faster results for their clients.

By leveraging AI, you can:

- Enhance client confidence with faster turnarounds and better candidates.

- Free your team from repetitive, manual tasks.

- Focus on building relationships and closing deals, rather than chasing outdated profiles.

Whether you’re an established executive search powerhouse or an up-and-coming firm looking to scale, reducing sourcing debt should be a top priority.

The Bottom Line

Sourcing debt may be a silent killer in executive recruiting, but it doesn’t have to be. By embracing AI and rethinking your approach to candidate sourcing, your firm can eliminate inefficiencies, improve client outcomes, and position itself as a leader in the field.

Take the first step toward a faster, smarter, and more effective search strategy. If you’re curious about how tools like SiftScore can fit into your process, let’s start the conversation. Whether or not you choose our platform, the key is to modernize now—before your competitors leave you behind.